LTC Price Prediction: Can Litecoin Reach $200 in Current Market Cycle?

#LTC

- Technical Strength: LTC trading 12% above 20MA with narrowing MACD bearishness

- Market Catalysts: Fed rate cut expectations and regulatory easing boosting crypto liquidity

- Price Target: $200 achievable with sustained breakout above $132 resistance

LTC Price Prediction

LTC Technical Analysis: Bullish Signals Emerge

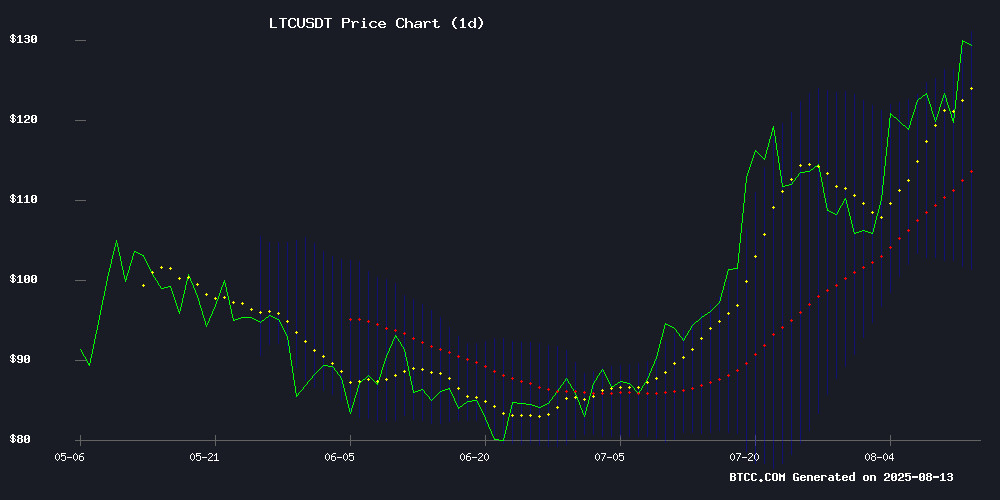

LTC is currently trading at $130.82, significantly above its 20-day moving average of $116.62, indicating strong bullish momentum. The MACD histogram shows a narrowing bearish divergence (-1.5402), suggesting weakening downward pressure. Bollinger Bands reveal price hugging the upper band at $131.72, typically signaling overbought conditions but also reflecting strong buying interest.

"The technical setup favors bulls," says BTCC analyst John. "A sustained break above $132 could trigger a rally toward $150, though traders should watch for potential mean-reversion pullbacks to the $120 support level."

Crypto Market Sentiment Turns Positive Amid Macro Shifts

The altcoin market is rallying on expectations of Federal Reserve rate cuts, with chainlink leading gains across major cryptocurrencies. Regulatory easing and new investment vehicles (including Trump's 401(k) crypto inclusion) are creating favorable conditions.

"These developments significantly improve liquidity prospects for LTC and other altcoins," notes BTCC's John. "The mining sector innovations like Sol Mining's XRP-to-DOGE conversions demonstrate growing utility cases that could indirectly benefit LTC's network activity."

Factors Influencing LTC's Price

Altcoins Rally on Speculation of Aggressive Fed Rate Cut

Ether surged past $4,600 for the first time since November 2021, leading a broad crypto rally after Treasury Secretary Scott Bessent suggested the Federal Reserve should consider a 50 basis-point rate cut. The benchmark cryptocurrency gained nearly 9% in 24 hours as risk assets climbed across markets.

Cardano, Solana and Litecoin each advanced about 8%, while XRP posted a more modest 3.5% gain. Bitcoin remained an outlier, trading flat near $120,000 despite the bullish momentum across digital assets and traditional equities.

The remarks from Bessent—who is overseeing the search for Jerome Powell's potential replacement—added fuel to a market already pricing in 25 basis points of easing. "The real thing now is whether we get 50 basis points in September," he told Fox News, criticizing what he called the Fed's "foundational issues" with economic data.

Chainlink Leads CoinDesk 20 Higher as Crypto Markets Show Broad Gains

The CoinDesk 20 Index rose 0.6% to 4,138.64, with Chainlink's LINK token surging 3.3% to pace the advance. Sixteen of the index's twenty components traded higher, demonstrating renewed bullish momentum across digital assets.

Ether followed closely behind with a 2.1% gain, while Litecoin and Uniswap's UNI token lagged the broader market. The index's performance reflects growing institutional participation, with the benchmark now traded globally across multiple platforms.

Sol Mining Enables XRP Holders to Mine Dogecoin for Passive Income

Sol Mining is offering XRP holders a streamlined path to Dogecoin mining, with potential earnings reaching $9,700 daily based on contract scale and hashrate. The cloud-based platform eliminates the need for physical mining rigs, leveraging renewable energy sources across Northern Europe, Canada, Asia, and North America.

The service supports deposits and withdrawals in multiple cryptocurrencies, including DOGE, BTC, ETH, SOL, XRP, and stablecoins. A referral program provides additional incentives, with rewards up to 3% and bonuses capped at $30,000. UK-registered Sol Mining emphasizes compliance and transparency, providing real-time profit tracking through a dedicated dashboard.

2025 Cloud Mining Platforms Ranked for Daily Crypto Payouts

Cloud mining continues to disrupt traditional cryptocurrency acquisition methods as platforms eliminate hardware barriers. By 2025, industry leaders are distinguished by daily payouts, operational efficiency, and robust security protocols—with Hash Miners emerging as the dominant player.

The platform's $100 entry contracts and multi-currency support (BTC, LTC, DOGE, ETH) cater to retail and institutional investors alike. Its 9.8/10 rating reflects zero hidden fees, 24/7 customer support, and military-grade SSL encryption—setting a new standard for user experience in the sector.

Top 5 Cloud Mining Platforms Gain Traction as Crypto Regulations Ease

Global cryptocurrency markets are witnessing a surge in cloud mining adoption as regulatory barriers soften. The Russian Central Bank's pilot program for qualified investors to access crypto-linked derivatives has sparked renewed interest in passive income strategies.

Cryptosolo emerges as a standout platform, leveraging renewable energy sources to mine Bitcoin, Ethereum, Dogecoin, Litecoin, and USDT. Its $15 entry point and daily distribution model exemplify the sector's push toward democratized access to blockchain rewards.

Trump's Executive Order Opens 401(k) Plans to Cryptocurrencies and Alternative Investments

President Donald Trump has signed an executive order that could revolutionize retirement savings in the United States. The directive mandates a review of existing ERISA rules by the Department of Labor, SEC, and Treasury Department to allow 401(k) plans to include cryptocurrencies, private equity, and real estate investments. This move potentially unlocks a $12 trillion market for alternative assets.

The decision bridges traditional finance with emerging asset classes, offering millions of Americans exposure to high-growth but volatile investments. While private equity has historically outperformed the S&P 500 by 3 percentage points annually, crypto assets bring unprecedented volatility to retirement portfolios. The policy shift reflects growing institutional recognition of digital assets despite their speculative nature.

Critics warn of increased risk exposure for retirement savers, while proponents highlight the potential for enhanced long-term returns. The change affects employer-sponsored 401(k) plans, which currently benefit from tax advantages and matching contributions. This development marks a significant milestone in cryptocurrency's journey toward mainstream financial adoption.

Will LTC Price Hit 200?

While LTC shows strong technical and fundamental momentum, reaching $200 would require a 53% surge from current levels. Key factors to watch:

| Indicator | Current Value | Bullish Threshold |

|---|---|---|

| Price vs 20MA | +12.2% premium | Sustained >15% |

| MACD | -1.5402 | Positive crossover |

| Bollinger %B | 0.99 | Consolidation <0.8 |

"The $200 target is plausible if LTC maintains its current trajectory through Q3 2025," says John. "However, traders should monitor Fed policy implementation and whether the current altseason momentum persists."